irs unemployment tax refund status 2021

Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. Progress of their returns and refunds.

Shocking Turn Of Events Fourth Stimulus Check Update Unemployment Up Shocking News The Daily Show Breaking News

Unemployment Refund by Rebecca Richardson Nov 30 2021 IRS Tallahassee Tax Service TallyTaxMan 0 comments.

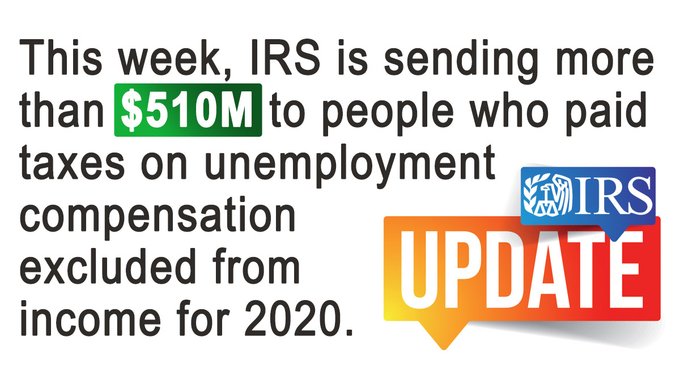

. It allows eligible taxpayers to report up to 10200 of their. Ad Learn How Long It Could Take Your 2021 State Tax Refund. The American Rescue Plan Act of 2021 was signed in March and temporarily revised the rules for taxation of unemployment benefits.

See How Long It Could Take Your 2021 State Tax Refund. Make sure its been at least 24 hours before you start. The American Rescue Plan Act of 2021 enacted in March excluded the first 10200 in unemployment compensation per taxpayer paid in 2020.

Your return has been processed and refund amount approved. The IRS agreed with many and has taken the following steps to improve the program in 2020. Check For The Latest Updates And Resources Throughout The Tax Season.

Your Social Security number or Individual Taxpayer Identification Number your filing status and your refund amount in whole dollars which you can find on your tax return. The American Rescue Plan Act of 2021 which became law in March excluded up to 10200 in. The IRS has identified 16 million people to date who may qualify for an associated tax refund or other benefit.

Unemployment Tax Refunds Update and Recap A little background in case you didnt know due to the recent passage of the American Rescue Plan. The American Rescue Plan Act had waived federal tax on up to 10200 of benefits collected in 2020. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

The American Rescue Plan Act had waived federal tax on up to 10200 of benefits collected in 2020. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. Ad Learn About The Common Reasons For A Tax Refund Delay And What To Do Next.

Viewing your IRS account information. WASHINGTON The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. The agency had sent more than 117 million refunds worth 144 billion as of Nov.

The federal tax code counts jobless benefits as taxable income. Using the IRS Wheres My Refund tool. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020.

To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns. 16 The IRS and the SSA have been collaborating to reduce the processing time of paper Forms W-2.

The 10200 is the amount excluded when calculating ones adjusted gross income it is not the amount of refund. IR-2021-159 July 28 2021. The IRS provides taxpayers whose refunds have been delayed by the PRWVH process with an interim letter every 60.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. Please select this button to close the Refund Status Help window. Dont expect a refund for unemployment benefits.

This tax break was applicable.

Tax Tip More Unemployment Compensation Exclusion Adjustments And Refunds Tas

![]()

What To Know About Unemployment Refund Irs Payment Schedule More

2400 Update Two Major Raises For Social Security Ssi Ssdi Stimulus Pa In 2022 Stock Market Tax Refund Daily News

Self Employed Tax Preparation Printables Instant Download Etsy Small Business Tax Small Business Expenses Tax Checklist

To See How Taxreform Affects Your Individual And Smallbusiness Taxes In 2018 Call Thecpataxproblemsolver Contact Us Payroll Taxes Tax Debt Tax Debt Relief

Irs Unemployment Refund Update How To Track And Check Its State As Usa

Just Got My Unemployment Tax Refund R Irs

3 12 154 Unemployment Tax Returns Internal Revenue Service

Millions Of Taxpayers Getting Surprise Bills Revised Tax Statements From Irs Irs Taxes Tax Irs

October 13 2021 Supply Chain News Supply Chain Long Beach Port Gas Industry

Where S My Refund Home Facebook

Centuryaccounting Posted To Instagram Do You Know The One Thing We Insist Every Taxpayer Should Do E File Their Ret Tax Refund Federal Income Tax Income Tax

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

The Irs Is In Crisis Taxpayer Advocate Warns Of 2022 Refund Delays

New Massive Package Coming From Congess Here S What It Means For Ameri In 2022 Tax Refund Irs Taxes American

3 12 154 Unemployment Tax Returns Internal Revenue Service

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Tax Refunds Who Is Getting Irs Compensation Payments Marca